Morocco

According to the MOM’s findings, nine of the 36 media companies involved in Morocco’s most influential media are directly linked to the state, the government or the royal family.

Four of them – SOREAD, SNRT, EcoMedias and Horizon Press – are among the most important media companies in terms of turnover and show the potential influence of politically linked media owners. The royal family itself is a leading media owner. Its holding company, the Société Nationale d’Investissement (SNI), has shares in four media companies, three of which are among the top five media companies (SOREAD, EcoMedias and Radio Méditerranée Internationale).

One of the key questions raised by the MOM’s findings is why leading figures from the business and financial world invest in newspapers that make no profit. Some of Morocco’s richest businessmen have stakes in five of the nine French-language publications examined by the MOM: Aujourd’hui Le Maroc, La Vie Eco, Les Inspirations Eco, La Nouvelle Tribune and L’Economiste. Two of these businessmen, Aziz Akhannouch and Moulay Hafid Elalamy, are also government ministers.

The Moroccan media landscape and its links to the country’s power centres have been closely scrutinized for the first time. The Media Ownership Monitor (MOM) sheds light on its faces and connections, and the impact of advertising – with its still opaque channels – on the funding of some media. It also looks at the flaws in the methods use to measure audience.

- TV mostly state-owned, online media more fragmented

“This study confirms that diversity and pluralism are not synonymous,” said Le Desk publisher Ali Amar, who supervised the research. “For the first time, a map has been compiled of the ecosystem of Moroccan media outlets that count. It confirms a disturbing tendency for a cartel with common interests to form at the intersection of the political and business worlds, a cartel that is undermining pluralism and therefore media independence.”

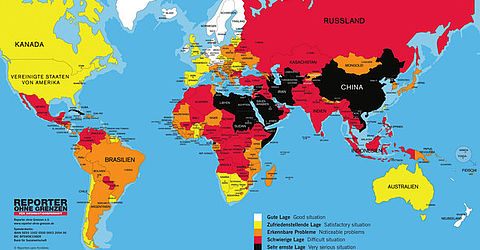

The MOM investigation, which took three months, focussed on 46 media outlets and the 36 companies that own them. It has revealed that each media sector – TV, radio, print media and digital media – has different ownership characteristics. The state is the leading owner in the TV sector, along with the royal family and one of Morocco’s wealthiest businessmen. The radio sector is dominated by the state but its ownership is otherwise more diverse, consisting of several smaller companies that have emerged in the past ten years. The print media are clearly split between Arabic-language outlets that are on the rise and whose owners mostly come from the world of journalists, and French-language outlet that are on the wane and whose shareholders include leading figures from the Moroccan business and financial sectors. The online media are still the most fragmented in terms of ownership. Conducted using the same standardized methods employed in similar MOM studies in other countries, this survey also uses a set of indicators that measure the risks to media pluralism in each country. In this respect, Morocco is located in the mid-range of the countries being studied, with a medium level of threats to pluralism.

“While the risks to media pluralism are not as great as in other countries, the MOM’s findings nonetheless show the need for reform,” RSF International president Michael Rediske said. “The royal family, government ministers and other powerful businessmen should not be in a position to control key media sectors.” RSF secretary-general Christophe Deloire added: “Defending journalistic independence vis-à-vis political and financial power centres must be a priority for media freedom in Morocco. We hope that that the Moroccan media sector’s players will be able to use this study to press for quality journalism that is free and independent.” Most of the information about media company ownership is dated and sometimes results in inconsistencies. Transparency laws and requirements exist but they tend to be bypassed.

Of the 36 companies surveyed by the MOM, 17 answered questions about their ownership structure. This is less than half, but it is more than in the 12 other countries in which MOM surveys have so far been carried out. In Brazil, for example, no company replied.

- No longer a state broadcasting monopoly but…

The Moroccan state’s broadcast media monopoly ended in 2005 but state TV channels are still watched by a majority of the country’s viewers and state radio stations still have many listeners. No fewer than 26.73% of listeners tune into the radio stations run by the state-owned Société Nationale de Radiodiffusion et de Télévision (SNRT), while 8.67% of viewers watch its TV channels. The part state/ part privately-owned SOREAD (of which 72% is owned by the Ministry of Economy and Finances and 20% is owned by the SNI) has 5.62% of radio listeners, while 33% of viewers watch its 2M TV channel. Both the SNRT (which receives 88% of public funding for the media) and SOREAD (which gets a great deal of advertising) have financial problems that raise questions about their long-term viability.

- Advertising Bias

The opaqueness of the Moroccan media market is also linked to the way the advertising market functions. The lack of fairness in the allocation of advertising helps to sustain an opaque environment that escapes public control and in which popular newspapers can be the victims of boycotts. This was the case with TelQuel, Nichane and Le Journal Hebdo at the start of the 2000s. The data analysed by the MOM shows that the TV sector is the most attractive one for advertisers, with a 39.8% share of the market in 2017. The next biggest share of the advertising market was taken by billboards and posters (29.10%), followed by radio (16.7%) and print media (13.2%).

- Audience impenetrability

As investment shows, Morocco’s biggest media owners are not particularly motivated by the size of their audience or readership, the measuring of which continues to be a problem in Morocco. Recognized entities exist but their data is often problematic, either because it is not publicly available or it cannot be used. Furthermore, market research also seems to subject to economic interests.

There are two entities that measure broadcast media ratings in Morocco. They are the Centre Interprofessionnel d’Audimétrie (CIAUMED) for television and the Centre Interprofessionnel de Mesures d'Audience Radio au Maroc (CIRAD) for radio. CIAUMED is operated by a coalition of economic interests that includes SNRT, SOREAD, Médi1TV and the advertising agency Régie3 (one of whose clients is SOREAD). CIRAD was set up in similar way.

For the print media, the Organisme Marocain de Justification et de Diffusion (OJD) is a recognized entity that publishes newspaper circulation figures. It publishes the figures provided by the newspapers themselves, after verifying them. In some cases, the figures are inflated by free distribution, which allows some newspapers to increase their earnings from advertising.

As in many countries, digital media audience measurement is not reliable because no specific entity is in charge. Advertisers regard Google Analytics as one of the best ways of assessing the number of visits. Although website owners can post this data on SimilarWeb, only some do. The buying of clicks or “likes” by both legal and illegal methods is also widespread.

- Implications of contradictory data

The MOM Morocco evaluated the availability of data to the public, as well as the data’s level of detail and credibility. All of the media surveyed bar two were registered with the competent authorities. Nonetheless, most of the information about their ownership is dated, with the result that data is sometimes inconsistent and unverified.

The media sector shares in the opaqueness that prevails in Morocco’s world of finance. According to Register of Commerce data, 40% of companies do not provide their accounts. In this study, 16 of the 40 surveyed media companies did not publish their financial information (including turnover, shareholders and number of shares issued) although transparency guidelines exist. Of the 17 companies that responded to the MOM’s request, three provided information that contained discrepancies with the publicly available information.

Some media companies lack an up-to-date entry in the central register of the Moroccan Office for Industrial and Commercial Ownership (OMPIC) although, in some cases, their capital structure has changed or is thought to have changed. When the MOM’s staff asked the High Authority for Broadcast Communication (HACA) for up-to-date information about companies with a presence in the broadcast sector, the request was refused. These companies nonetheless provide the HACA with this information every year.